The Day I Banned Social Security Debate from My Economics Classroom Forever

How the federal government spends your tax dollars, the concern over the debt, and rising health care costs

Note to those in other countries: While I’m specifically talking about the US federal government, you will see strong parallels between your own governments and ours in the first section. The components of GDP are the same everywhere because they are the theory behind the measurement of GDP.

I always told my students to check their politics at the door when I started discussing fiscal policy. Not all of them were successful. The impetus for this came from a skirmish in my classroom during my first semester.

I said a few things about Social Security and one young woman argued that everyone needed to take responsibility for their own retirement. Another woman countered with the argument that not everyone had the opportunity for the kinds of jobs that allowed them to save. For the next minute or so, the two women railed at each other.

I was in shock and didn’t respond quickly. I then stopped class and sent everyone home.

I also never mentioned Social Security in class again.

But it is an important part of government spending. The top three categories of government spending are defense, Social Security, and Medicare, in that order. Social Security and Medicare have specific taxes to offset the expenses.

The federal government also spends money on salaries and health care for its workers in addition to providing other programs.

How the federal government spends your taxpayer dollars

The federal government also spends money investing in equipment, buildings, and infrastructure. Instead of buying police cars like local governments do, they buy aircraft carriers. Instead of fire houses they built a new headquarters for the FBI.

And instead of building local roads, they provide funds for new interstate access, as I noted in the last post, 7 Everyday Things Around You that Your Tax Dollars Paid For. (The link is at the bottom.) For example, I remember when they rebuilt the I-85 coming from the perimeter (I-285) northeast of Atlanta. The old I-85 became the access road.

All of this depends on our demand for government services. This demand peaked during the early days of the pandemic and has since waned.

Other determinants of federal government spending include legal requirements and the business cycle, as we discussed in the post on fiscal and monetary policy. (That link is also below.)

Tax receipts also determine to a certain extent how much our government can spend. Or at least, it used to.

The cheat sheet for government spending and investment was in the earlier post and is here.

In a future post, I’ll look more at federal taxes in the US. But for most of us, the federal government taxes our income from all sources received. It also levies a tax to cover Social Security (FICA taxes) and Medicare.

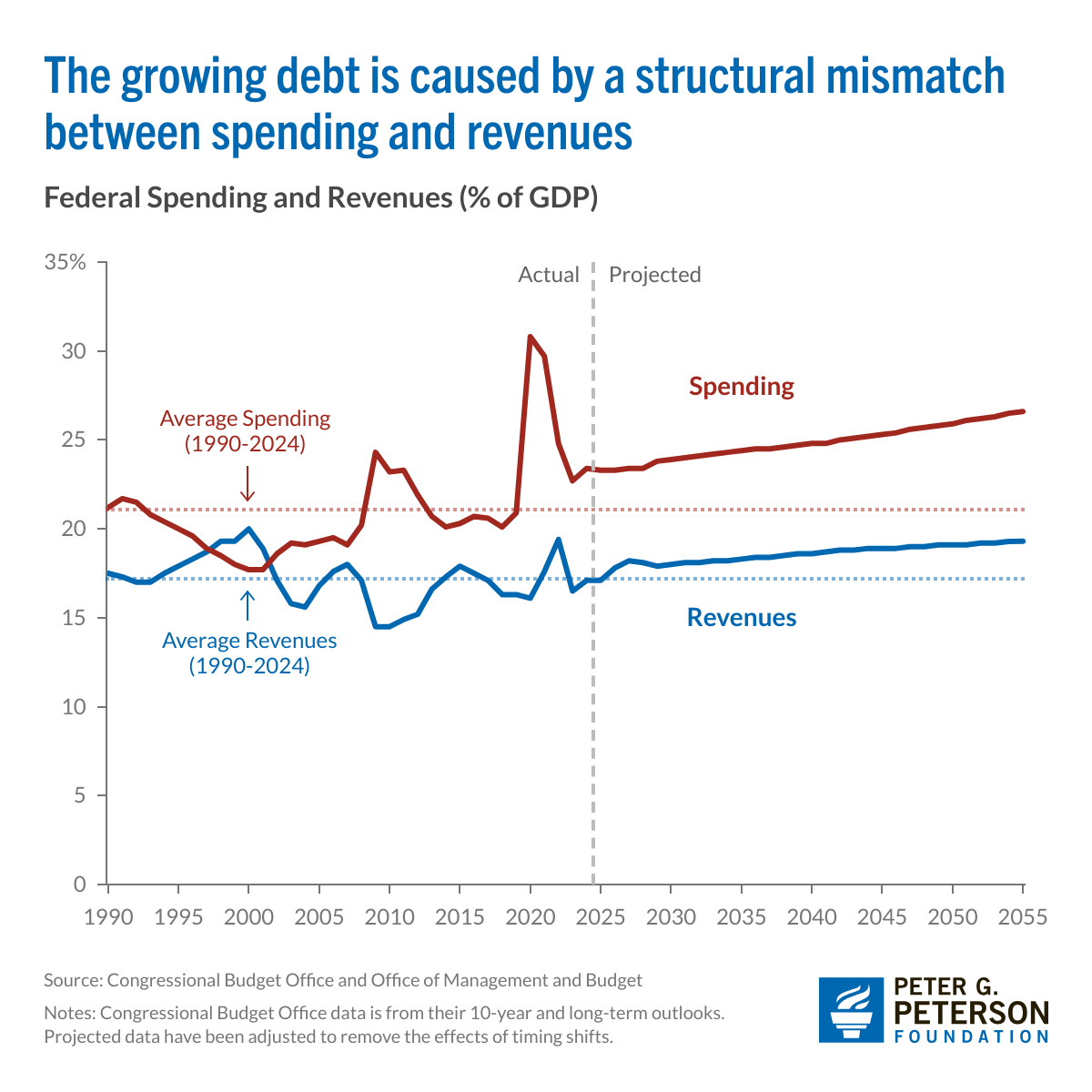

But lately tax receipts have fallen short of spending. There are several reasons this, including an ill-conceived tax reduction plan in 2017 and the failure of the two parties to come to terms with budget cuts.

The growing US debt and the problems we face

But the growing debt is an issue. Here are ways the debt affects us.

First, interest payments are the fastest growing category of spending by the government. If this continues, then spending will have to give somewhere else in the budget.

Interest rates are also higher than they could be. As the federal government demands more of the pool of money from savers, the price of money goes up. The price of money is the interest rate.

In addition, the downgrading of US government securities by the major ratings firms means that the government will have to pay higher interest rates than they used to. There is no longer as much certainty that the US government will pay its debts. Foreign (and some domestic) suppliers of funds need convincing to stay in a less certain market.

Rising interest rates caused other problems too. Homebuyers will find it even harder to afford a home. The Federal Reserve may not be able to bypass these higher interest rates if the country goes into recession.

Rising interest rates crowds out private investment since they will need a higher return on investment (ROI) to make new purchases worthwhile. Lower Investment leads to lower productivity gains which may cause slower gains in the standard of living.

If the government has to decide between programs, they could choose to decrease public investment in infrastructure. There could also be cuts to social programs.

Spending on healthcare will increase

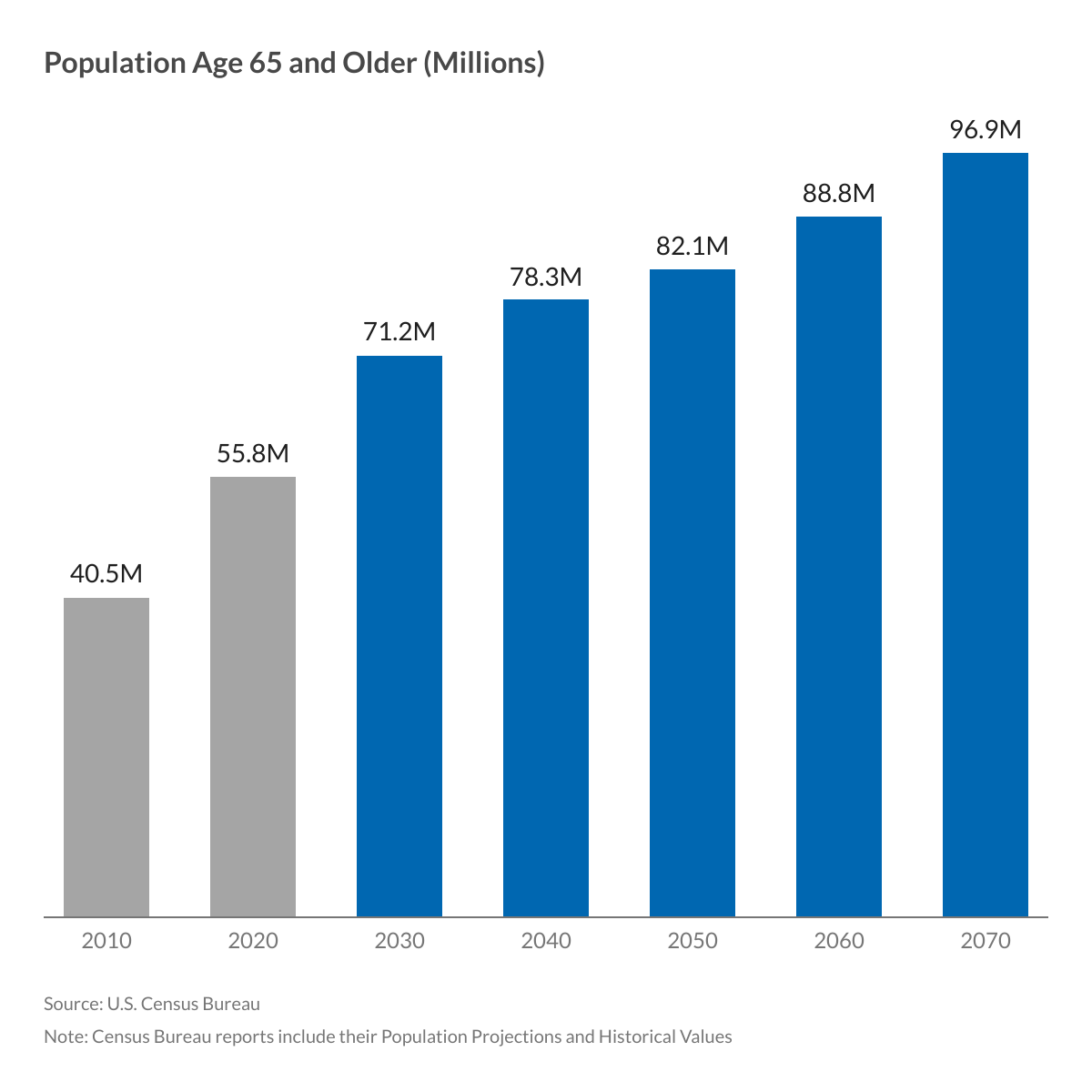

Meanwhile, spending on social security and health programs, including Medicare is only going to rise.

Everyday 10,000 people turn 65. Nine out of ten of them will sign up for social security. All of them will sign up for Medicare because they face penalties if they don’t. An aging population demand more health care services.

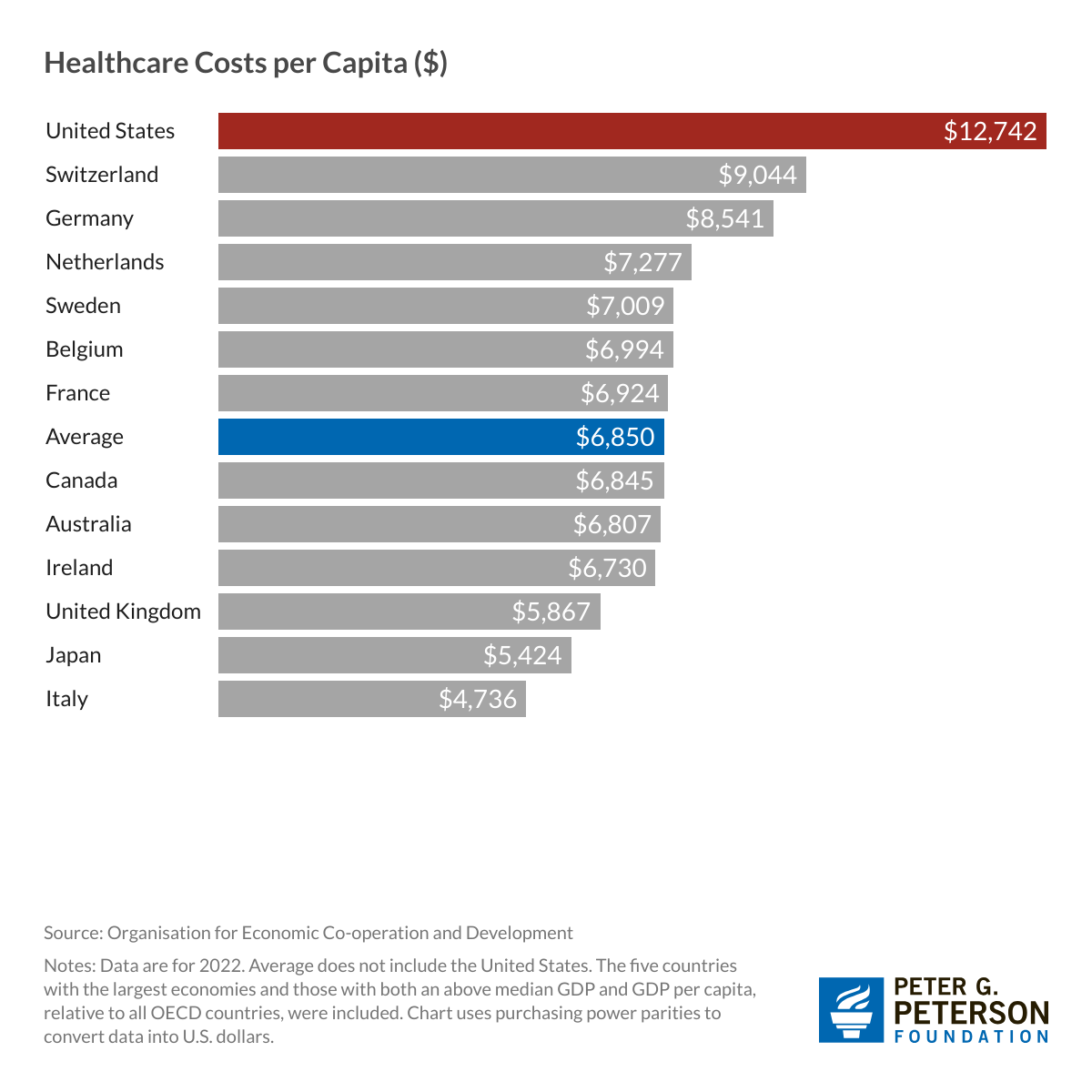

In addition, health care costs have been rising. In the US, we outspend all other wealthy countries on health care. Those costs have risen over time.

The federal budget needs flexibility to meet those needs. The budget doesn’t have that now.

In the next post, we’ll look at the last two components of GDP, exports and imports.

As always, thank you for taking the time to read,

Nikki

Links to posts:

7 Everyday Things Around You that Your Tax Dollars Paid For

On the way to Epworth, GA on Thursday, we stumbled onto something wonderful—an express lane from I-75 to Highway 5 that was open. If you live and drive near an urban area like Atlanta, then you know what a boon saving a few minutes in traffic is.

Who Actually Controls the Economy? It’s Not Who You Think

Since the beginning, the US economy has grown.

New Voiceover:

I Owe, I Owe, It’s Off to Work I Go!

In “Would You Buy a $300 Pair of Socks?”, we looked at households as consumers. [1] But households also work and save.

Nikki, Been super busy and miss talking to my Fav economist. I believe that the addition of SS benefits in '35 was a mistake. People should have to plan for themselves we shouldn't become a Socialist country. By the way, I love Peterson's web site. Even though he was, the father, a Democrat and Commerce Secretary under Clinton, the son is running a fairly middle of the isle organization. By the way, with SS what doesn't any of the employer match, the other 6.25 %, benefit the worker? talk soon Joe Z

I agree. We should plan for ourselves. Relying solely on the government is the worst plan anyone should make.