Who Actually Controls the Economy? It’s Not Who You Think

The tools the fiscal and monetary authorities use to combat inflation and unemployment.

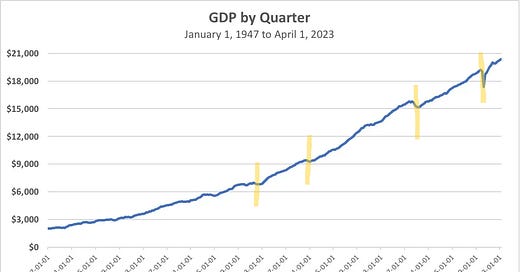

Since the beginning, the US economy has grown.

A dynamic economy grows over time. But sometimes the economy slows. In the last 50 years, dips (or recessions) occurred in 1983, 2001, 2008, and 2020. [1]

Sometimes inflation gets too high, as it did in 2021-2023, and needs cooling.

But who does this work?

We’ve discussed the role of the Federal Reserve in cooling the economy, but I’ll summarize their work again later in this piece.

But what about when the economy is in a recession? Who takes charge then?

There are two authorities responsible for economic stability and policy in the US: the fiscal authority—Congress and the President, and the monetary authority—the Federal Reserve.

In other nations, the fiscal authority might be parliamentary, where bills originate from the heads of state and pushed down to parliament. In Congress, bills originate in Congress and are then sent to the President.

In most countries the monetary authority is an autonomous central bank, such as the Bank of England and the Bank of Japan. In the Euro Zone, Nineteen countries have adopted the euro and ceded monetary authority to the European Central Bank.

When we study the whole economy, or macroeconomics, the focus is on stabilization problems and policy. The problems that we deal with are unemployment, inflation, and trade.

The policy options are government spending, taxes, and the money supply / interest rates. The federal government and the Fed can also enact laws to pursue policy.

So why do you need to know this?

In the summer of 2007, the subprime mortgage crisis began, leading to the global financial crisis that caused the recession of 2007-2009. In October 2008, the stock market crashed, leaving investors with about half of their original value. Worse, an unexpected surge in gasoline prices to $4.11 a gallon at the pumps hit in July ($5.40 in 2021 dollars).

I had several speaking engagements at the time. One was with an agitated group of women business owners in Clayton County, GA.

But I left the women’s business group buoyed with a quote that the American economy would recover quickest from the global recession because of its people. I urged them to keep going.

I was teaching economics at Clayton State University at the time. Everyone I met, from students to line workers to business managers and owners, were worried. For instance, Spalding County saw unemployment rates soar to an average of 14.8 percent in 2009. They all had questions.

But what stuck with me was one question a student asked: Why is it taking so long for the government to do anything?

Everyone was in panic mode. It was more important to know what Congress was going to do and when.

So, let’s take a quick look at what the government can do.

Fiscal Authority and Fiscal Policy Variables

Our federal authorities include Congress and the president. They control government spending and taxes.

They spend their funds, plus anything they borrow, on defense and education, social net programs, supporting a functioning judicial system, and on infrastructure, such as highways and buildings.

They also have the legal power to enact new taxes or implement tax credits to reduce taxes in times of crisis.

The federal authorities use changes in spending and taxes to stabilize the economy. In policy there are two kinds of stabilizers: automatic and discretionary. Automatic stabilizers kick in when the economy changes.

The government does not have to do anything, other than pass a budget. [2]

Automatic Stabilizers

Suppose the economy falls into a recession, with lower output and unemployment. As employment falls, newly unemployed workers who are eligible for unemployment insurance can apply for and get unemployment insurance benefits for 26 weeks.

This benefit helps offset lost wages.

Eligible workers can also apply for benefits from aid programs such as Temporary Aid to Needy Families (TANF), Supplemental Nutrition Assistance Program (SNAP) and Women, Infants, and Children (WIC).

During recessions, older or disabled workers who can’t find work can retire to collect social security benefits. The offset in wages allows for spending that helps stabilize GDP and minimizes future job losses.

Discretionary Stabilizers

Discretionary stabilizers require action on the part of Congress and the President.

For example, during the Pandemic, more workers were eligible for unemployment benefits. In addition, Congress enacted bills to add extra income to benefit programs and extended the time unemployment insurance benefits were in effect.

As government spending rises, GDP also rises to fight against reductions in spending by consumers and businesses.

Taxes also affect household and business spending. Here’s an example.

If taxes fall, particularly income and payroll taxes, then paychecks rise, so there is more money to spend on goods and services. At the start of the pandemic (March 2020), when the CARES Act passed, child tax credits lowered taxes for working Americans. [3]

Increases in taxes rarely happen because they can be political suicide for the members of Congress. However, in 2023, Congress effectively increased taxes, by letting those added child tax credits lapse.

But what do we do if our fiscal authorities can’t use the right fiscal policies, reducing spending and increasing taxes, during inflationary times. [4]

Then we turn to our monetary authority, the Federal Reserve (also called the Fed).

Monetary Authority and Monetary Policy Variables

I covered much of this in my Crash Course on Inflation, but this a quick reminder.

The Fed traditionally has one policy variable it can use, the money supply. [5] The money supply is the amount of money currently held in currency and checking accounts.

The goal, during economic upheavals, is to change the money supply.

The way the Fed changes the interest rate banks charge each other (called the federal funds rate) is by buying and selling bonds.

This action leads to changes in other interest rates, such as mortgage rates and the rates on other loans. In But that’s the lowest rate I ever paid!, we looked at how this affects the economy (and GDP).

Armed with this information, we know how the fiscal and monetary authorities tackle two big problems that affect the economy—high unemployment and high inflation.

In the next two-three posts, we’ll look at how the government applies these potential solutions to rising unemployment.

Looking forward to seeing you then!

Thanks for reading,

Nikki

[1] Note that the dip in 2020 was not long enough to be a recession.

[2] I’ll leave it to the political scientists to go into that problem.

[3] Coronavirus Aid, Relief, and Economic Security Act.

[4] In the past two inflationary periods, our fiscal authorities have increased government spending and lowered taxes. Both are inflationary policies.

[5] This changed during the 2007-2009 recession when the Fed introduced large scale asset purchase (LSAP) programs. See The Great Recession of 2007-2009 by Robert Rich.

What people don’t realize is the federal reserve is not even federal and there’s a whole story behind that as you probably know.

I believe we’ve been in a recession and have been, and if things don’t change, we could go into a depression. I’ve heard that from other experts as well and hope that doesn’t happen.

I worked for the government for five years and I know they do not know how to do math- they’re talking about inflation at 3% or something like that and the people that really know how to do the math are saying it’s more like 30% - all one has to do is look at what they were paying last year and the year before and not even that it’s the taxes that they’re putting on everything that is also increasing.

Sad…..