🎧 Would you buy a pair of $300 socks?

What do consumers in the US economy do? Life stage spending and the spending on services, durable and nondurable goods.

I wouldn’t, but I’m sure the salesperson at Loro Piana would love to sell a pair of cashmere Cocooning Socks to you.

Think about yourself and your household. You wear three hats. One is your consumer hat. The other is your worker hat.

The last is the hat you put on to decide how much you’ll save.

Why did I choose to talk about Consumption first?

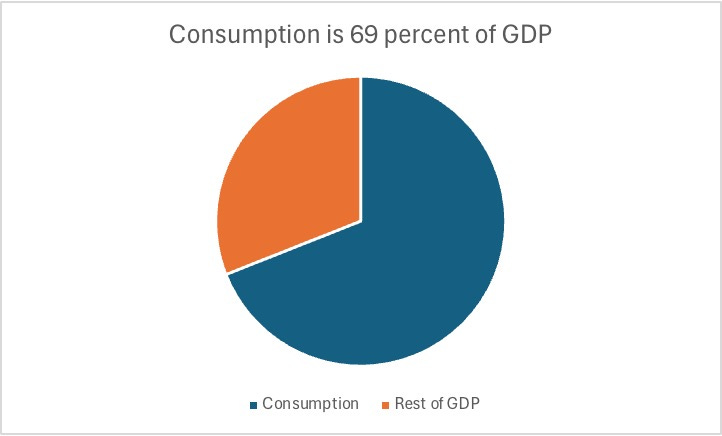

Consumption in the US is about 69 percent of US GDP, making it the critical component (or part) of GDP.

Looking at the places where most of my readers who aren’t in the US are located, you’ll see differences. In Canada the proportion is 55 percent. In the UK it’s 61 percent. Australia and Germany both clock in at about 50 percent.

As a consumer you want low prices, a lot of choices, and convenience. We’ll talk about your role as a worker and saver in Parts 2 - 4 of this series on Consumption—what households spend on domestic goods.

Consumption depends on prices and other factors

Prices drive what you and your household buy. So do availability, your tastes and preferences, and what you need and want. In some cases, you might be driven by interest rates. What constrains you is your income. Unlike the Federal government, you must balance your budget.

You can put off balancing your budget by borrowing. As my friends

and put it, you live in one of three stages of life:Your income equals your spending.

Your spending is more than your income.

Your income exceeds your spending.

At our age, my husband and I are in a modified Stage 1. Our income is from retirement savings and covers our current spending.

Many Americans got stuck in Stage 2 during the pandemic.

We bought big-ticket items—tickets to concerts by Taylor Swift and Beyoncé, high-priced luggage, and travel, to Europe and Asia.

In GDP, what consumers spend (called Consumption) is split into three parts:

Durable Goods

Nondurable Goods

Services

Durable goods include refrigerators, computers, and cars. If you’re like me, you only buy these goods when they need replacing. Some people buy cars and computers more often. Our car is a 2019 Honda CRV.

I talked about that in my series on The Great Car Switcheroo of 2022.

Our refrigerator came with the house we bought in 2021. It’s from a remodel done in 2020. The computer in my office is at least a decade old. And the iPad I use to compose these posts is 4th generation, also from 2020.

I would love to replace my iPad with the newest model. I would also like to replace my car with a slightly bigger one that makes long trips easier on me. But my refrigerator and the other computer are just fine.

What keeps me from replacing the iPad and the car?

Constraints on spending include income income and interest rates

It’s my income and my desire for other stuff. As Brian Herriot states, “you can buy anything, but you can’t buy everything.” For most Americans, high interest rates in addition to high prices have kept them from replacing their cars.

Non-durable goods, like bananas, milk, and clothes depend most on needs, wants, prices, and availability.

As a teenager in Fannin County, GA, getting clothes meant a two-hour drive to Cumberland Mall. My mother hauled my sister and I to the mall once a year, sometimes twice, to replace clothes and buy records and 8-track tapes. [1] Since my brother was tall and always growing, she bought his clothes from the JC Penney catalog store in McCaysville (GA).

Yes, a catalog store. There was no internet in the 1970s.

Now, instead of a physical product, the music I buy comes in digital form.

Consumption has changed a lot since I was a teenager. Back then most of our goods came off shelves. Now, most of our spending is on services.

From 1974 to 2024, the proportion of Consumption we spend on services rose from 52 percent to 69 percent.

Services include haircuts and banking and deck repair. Again, these depend on income, prices, and needs and wants.

For instance, although the $300 pair of socks is imported from Italy and taken out of GDP, the retail markup and commission on the sale is part of spending on services. Distribution and warehousing costs would also be domestic once the socks got to the US.

The links to parts 2 - 4 are below:

Thanks for joining me,

Nikki

[1] 8-track cassettes were a short-lived phenomenon in the 1970s. By 1982, CDs had replaced them. Now, we buy mp3s or listen to playlists.

Workers: https://nikkifinlay.substack.com/p/i-owe-i-owe-its-off-to-work-i-go

Household Savings 1: https://nikkifinlay.substack.com/p/is-household-saving-bad-for-the-economy

Household Savings 2: https://nikkifinlay.substack.com/p/the-hidden-ways-americans-save

Nice piece, Nikki. If we'd get planners and money writers to present the life-cycle approach, every household would know their spending cap for the current year and whether to save or not.