🎧 Why Your Big Tax Refund Is Actually A 0% Interest Loan To The Government

Are you getting refunds from the IRS every year? Also saving by building human capital and equity in your home

Do you pay extra taxes on each paycheck?

If you’re used too getting large refunds from the IRS each year, you are. And you’re paying too much.

Some of us do this to avoid owing anything the next year. But some of my students did this to have a lump sum available the following year. They used the IRS as a bank and the extra taxes as a way to save without needing the discipline to stay away from the funds.

I did this too for a long time until we blew a large refund on a vacation we couldn’t afford. Then I started following Henry Bloch’s advice (from the H & R Block television commercials) to aim for a small tax bill the next year.

This behavior is also true of those eligible for an Earned Income Tax Credit (EIC). They don’t get the funds with their paycheck as the program is designed.

In the previous post, we looked at why and how we save. In the rest of this post, we’ll look at two other ways we save and how savings can be good for an economy.

Why we buy houses

Most of us buy a house for two reasons. A home yields a stream of protective and comfort services over the time we live there.

A home also usually increases in value. Over the course of a lifetime, you may buy several homes. We’ve bought four so far. Each had more space and was more expensive.

But at some point, we’ll buy a smaller house and take out the equity we’ve built and use it for retirement. The tax code has an incentive built in.

If you buy a more expensive house with proceeds from an earlier purchase, you don’t have to pay taxes on the profits.

If you sell a home after turning fifty five (55) and then buy a new home that has a lower price, you don’t have to pay taxes on the profits on the first $250,000 profit if you’re single or $500,000 if you’re married filing jointly.

When we buy a home, we free up rental housing. This lets new households find shelter.

The same is true for buying a better, higher-priced home (whether bigger or not). You free up less expensive homes for younger households.

There is a residence requirement and certain exclusions you’ll need to check before you can claim this. I’m not a licensed tax accountant or financial advisor, so be sure to check with someone before you sell your home if you’re over fifty five (55)!

The role of college education

In the previous post, I said that many Americans also save or “invest” by spending money on a college education.

A college education yields what we call human capital. Human capital is our stock of knowledge, skills, and experience. We use this to earn wages.

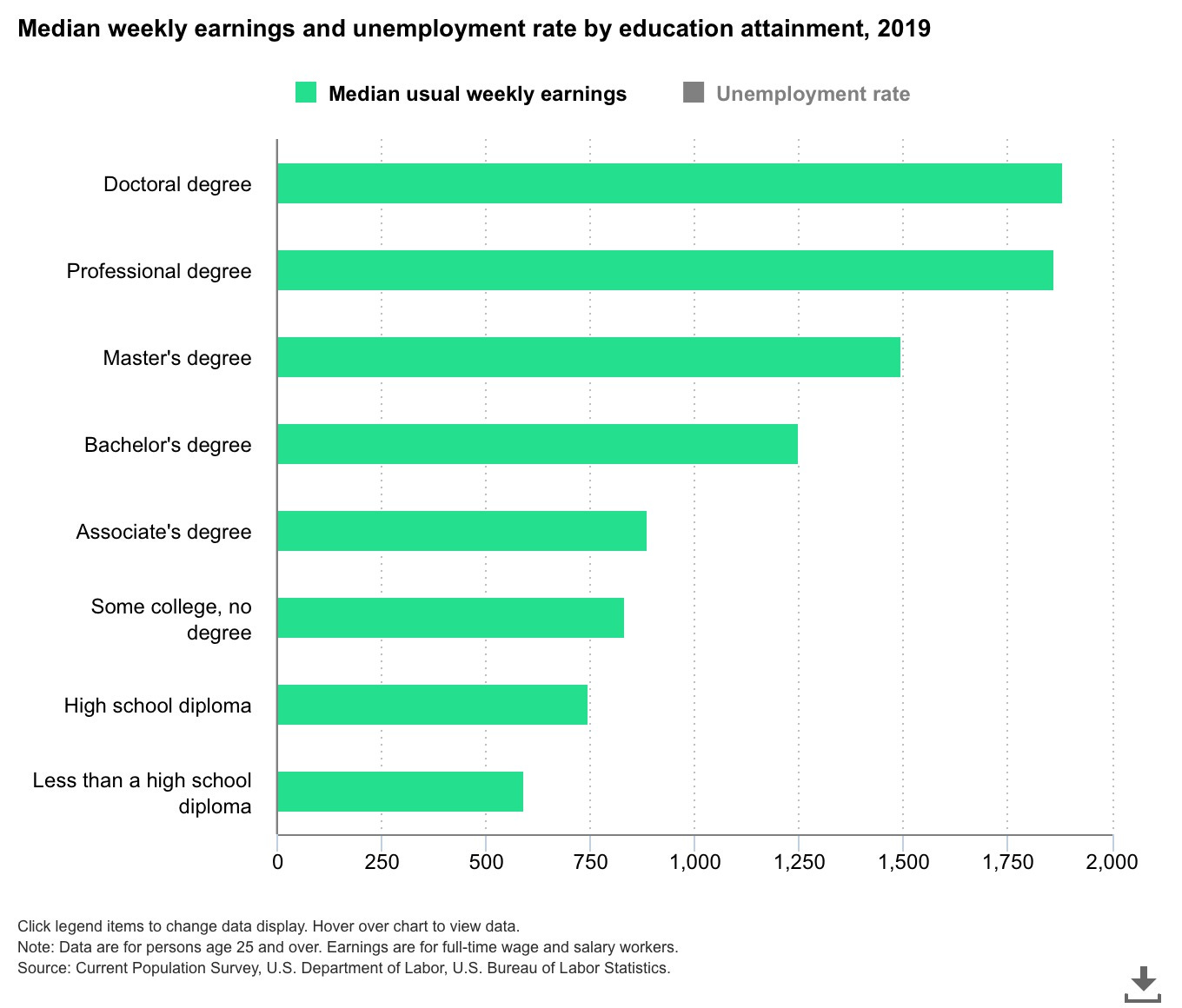

The more time you spend in college, the more your expected earnings will exceed what you could have gotten if you only got a high school education. [1]

But going to college isn’t the only option for building human capital. Apprenticeships, internships, and vocational training are also good ways to build human capital.

Saving by putting money into a college education or training program helps GDP grow in the long run. As we grow our skills and education, we’ll gain experience. Then we’ll be more productive.

Labor productivity, the amount of GDP that each labor hour produces can grow. If we spend time learning our jobs and get better at doing it, then we can spend less time working while getting more. We can do this by learning more, by using better equipment, and by using better software, including AI assisted programs.

Increases in labor productivity helped workers in this country move from 12-hour days six days a week to 8-hour days five days a week in the twentieth century.

And according to the Office of Disease Protection and Health Promotion, Americans with higher education and marketable skills use less sick leave. They cost the country less in medical expenses in their working year.

These workers are also more active in their communities and more likely to give in rough times.

That is also what Investment does for businesses.

Why it’s good for the economy if we save

Money set aside into a savings account or money market earns interest. If the Federal Reserve is raising interest rates, then the interest on savings rises.

That’s good for you for short-term savings.

The money in short-term savings plus what you put in checking to be spent is the money supply.

During my Crash Course on Inflation, we learned that M1 was the definition of the money supply. It includes cash and money in checking accounts.

This is the most liquid form of money.

M2 includes money that is easily converted to cash, like money in savings accounts or money market funds.

This savings plus any excess reserves a bank has is part of the supply of funds banks have to loan to businesses. [2] The greater that supply, the lower the interest rate they can charge on loans to their best business customers.

That’s good for Investment.

Investment is business spending on capital equipment, structures, including new housing, and inventories. Investment is also the second component of GDP.

Any money you put into corporate and municipal bonds also supports Investment—both by private firms and by the government. We’ll look into Government Spending and Investment. in a later post.

The more a business invests, the more productive they are. A productive business has higher expected profits. As production and profits rise, unemployment may fall.

But GDP does go up, since GDP is the value of production.

We’ll talk about Investment in a later post. The next post will be on tariffs.

Thank you so much for reading,

Nikki

[1] This is true for most people who have a college degree. There are always exceptions.

[2] You may want to read In Balance: The Role of Banks and One Rate to Rule Them All to learn about money or to brush up.

Always good information, Nikki. Basics are important.