In Balance: How Banks Create Money

The role of assets, liabilities, and reserves in the economy

I want you to try something.

An Experiment

I want you to think about the stuff you have in terms of money. I know, I know. There are all kinds of reasons not to do that. But just for a moment, I want you to think about the things you own. No, we’re not doing death cleaning or decluttering either. Though you might want to later.

Some of those bits and bobs have special meaning for you. I’ve got letters tucked in pages of books, like a note from Mimi (my maternal grandmother, Grace Dodgen, nee Briscoe) in an Agatha Christie paperback that was old when she bought it (for a dime). The book is falling apart. My husband asked whether he should toss it, and I said, “you and the kids can do that when I’m gone.”

Some of that stuff has real value in the market. My husband has a collection of Magic the Gathering ® cards from the 1990s. He has them out to sell. But this is one of those years not to make decisions or engage in difficult activities. [1]

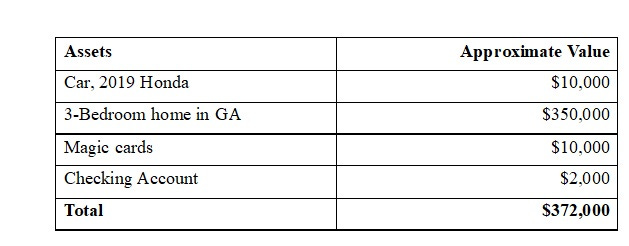

But they have value in a market. So does our car and our home. So do some pieces of furniture we inherited that I might sell. I can label all those things I can sell in a market and call them assets. You can do the same. Just take a minute. Maybe you’ve got an old car that doesn’t run well. Pristine parts are worth a few bucks to someone. [2]

Here’s a list I made, with some values added:

If you are buying a home, put down the price you can get for it. We’ll add the mortgage separately. I kept the list simple. You should too. If you want to inventory every item you have, you can, but for now put your perfectionist hat away.

Now let’s look at the money you owe. Suppose that car and house would have loans associated with them. Also, suppose I bought a sofa with a 12-months-same-as-cash card. Let’s make a new list:

You could of course go crazy with this. Resist that urge. This is good enough.

We’re missing a piece of the puzzle, because our balance sheet doesn’t balance. Assuming you have the income to pay off those debts, you’re okay because the value of your assets exceeds your liabilities.

How Banks Differ

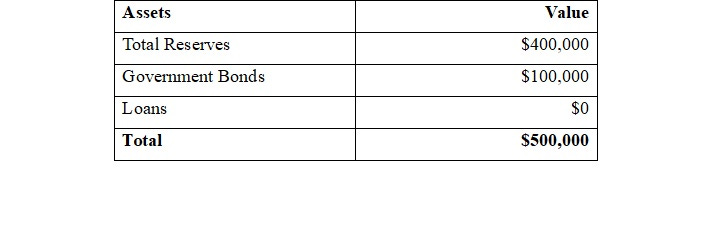

Banks don’t have this option. They must balance their books every day. Here’s what a banks assets and liabilities might look like:

Notice the differences: Where checking account balances are an asset for you, for the bank checking account balances are something that belongs to their customers. Loans are also different. You have to pay yours back. The bank owns your loans. For a bank, loans are an asset and checking accounts are liabilities.

Two more pieces of the puzzle. Federal law requires banks to keep a certain amount on reserve. How much? To some people this number is shocking. The reserve ratio is between 3 and 10 percent of your account, depending on the size of your bank.

When I told this to the granddaughter of a prominent businessman in the southern crescent of Atlanta, she didn’t believe me. “They do what?!!” Her bank is a large one, so for every dollar she put into her checking account, her bank loans out 95-97 cents.

That’s why it’s a good idea to keep a buffer in your checking account, as much as you can give up without a problem. In 1990s, I kept my checkbook ledger set to $-300. My husband found one and nearly had a heart attack. All those red lines.

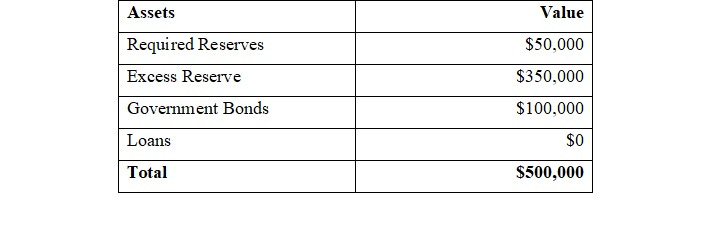

Here’s what the bank’s account looks like with reserves split into required and excess reserves, with a 10 percent reserve rate.

The bank then takes those excess reserves and makes loans.

With a reserve rate of 10 percent, they can loan out 90 cents of every dollar their customers deposit into checking accounts. That’s the $350,000. But that’s not all they can lend from those excess reserves.

They can lend as much as $3,500,000!

How Banks Create Money

The act of loaning money to a customer creates money. Look at that sentence again. When banks make loans, they create money. In this case, they can create $3,500,000. This is how the money supply rises, the other side of the inflation picture. Decreasing the money supply is a very important part of the story we’ll tell in the last two posts.

Making loans is also how banks make profits. Many of those loans are to other businesses. In a chat with the previous CEO of a large community bank during the recession of 2008-2009, he said, “I look out my office window and see all those cranes stopped and I want to help. We’re holding on to more reserves. And they may have loans from larger banks.”

Banks can choose to hold on to some of those excess reserves, as they are doing again now. Or not. In the next two posts we’ll look at banks and the Federal Reserve and finish our Crash Course on Inflation.

Thank you for taking the time to read my work. Questions and comments always welcome.

Nikki

[1] They will come or maybe they’ve already come for you. A divorce, a birth, a death, a medical issue. You’ll know it when it gets here.

[2] So are the heavy metals in catalytic converters, which is why people keep stealing them. It’s big business in the south.

Nikki, thank you for simplifying these concepts. So easy to understand even for me!